Top Guidelines Of Clark Wealth Partners

Table of ContentsOur Clark Wealth Partners PDFsHow Clark Wealth Partners can Save You Time, Stress, and Money.Some Known Incorrect Statements About Clark Wealth Partners What Does Clark Wealth Partners Do?Clark Wealth Partners Can Be Fun For EveryoneThe 25-Second Trick For Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is DiscussingFascination About Clark Wealth Partners

There's no solitary path to coming to be one, with some people starting in banking or insurance policy, while others begin in accountancy. 1Most monetary coordinators begin with a bachelor's level in financing, economics, audit, company, or an associated subject. A four-year level provides a solid structure for occupations in financial investments, budgeting, and customer service.Lots of aspiring organizers invest one to 3 years constructing these functional skills. The test is used 3 times every year and covers areas such as tax, retirement, and estate preparation.

Usual instances consist of the FINRA Collection 7 and Series 65 exams for securities, or a state-issued insurance policy license for offering life or medical insurance. While credentials may not be legitimately needed for all intending duties, companies and customers often view them as a criteria of professionalism. We check out optional qualifications in the following section.

8 Simple Techniques For Clark Wealth Partners

The majority of monetary coordinators have 1-3 years of experience and experience with economic items, conformity criteria, and straight customer communication. A strong educational background is vital, however experience shows the capability to apply concept in real-world settings. Some programs integrate both, permitting you to complete coursework while gaining monitored hours with internships and practicums.

Numerous go into the field after working in banking, accounting, or insurance coverage, and the change needs perseverance, networking, and frequently advanced credentials. Very early years can bring long hours, stress to build a client base, and the demand to continuously show your expertise. Still, the occupation offers strong lasting potential. Financial planners enjoy the opportunity to work closely with clients, overview essential life choices, and commonly achieve adaptability in timetables or self-employment (financial planner scott afb il).

A Biased View of Clark Wealth Partners

To end up being a financial planner, you generally require a bachelor's level in finance, economics, company, or a related topic and several years of appropriate experience. Licenses might be required to sell safeties or insurance coverage, while certifications like the CFP enhance trustworthiness and job possibilities.

Optional certifications, such as the CFP, commonly need extra coursework and testing, which can extend the timeline by a couple of years. According to the Bureau of Labor Statistics, personal economic experts gain a mean annual yearly wage of $102,140, with leading income earners earning over $239,000.

Getting My Clark Wealth Partners To Work

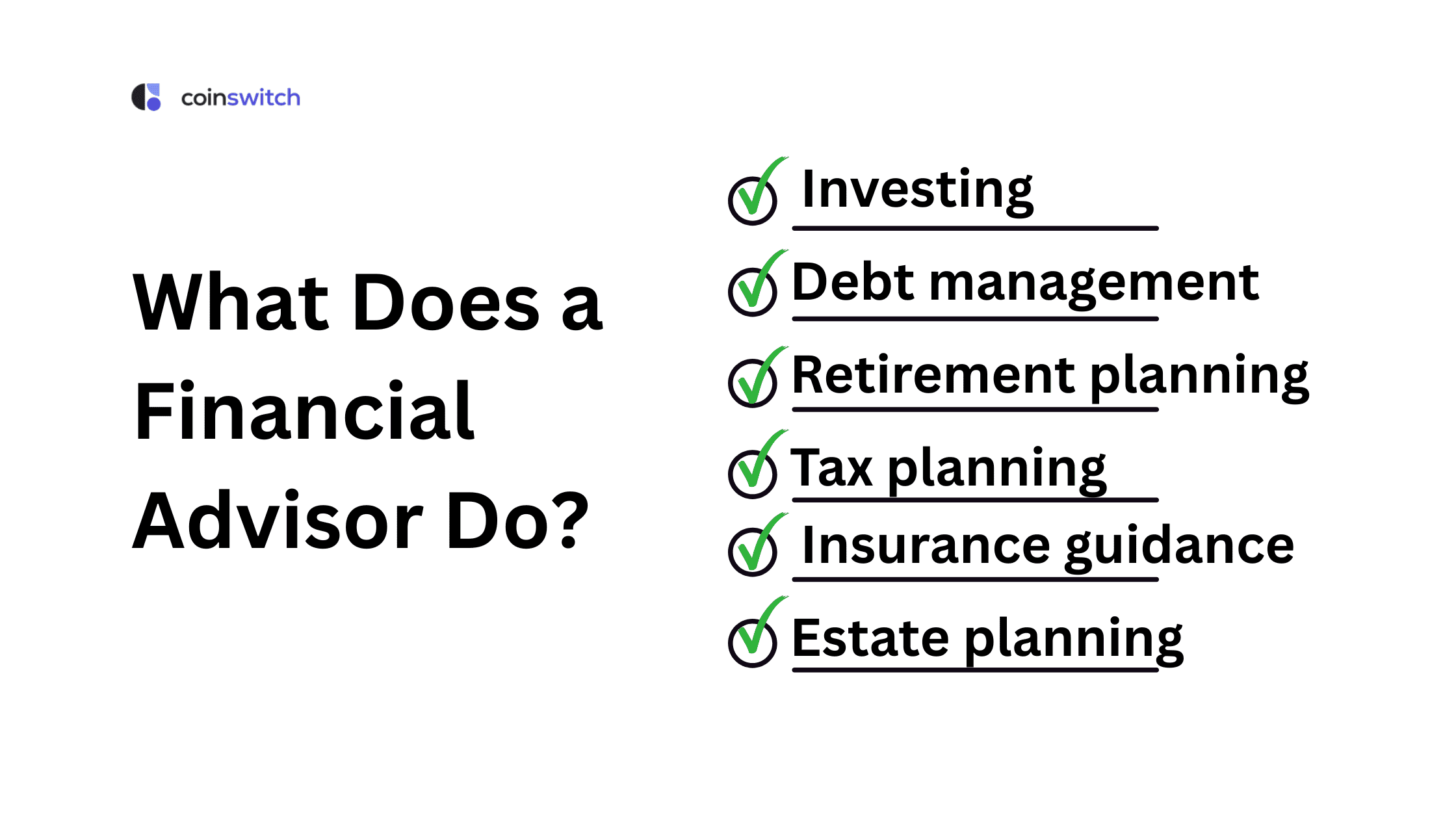

will certainly retire over the next years. To fill their footwear, the nation will require more than 100,000 brand-new economic experts to enter the sector. In their day-to-day job, financial experts take care of both technical and imaginative jobs. U.S. News and World Report ranked the function amongst the top 20 Finest Business Jobs.

Assisting people attain their financial goals is a financial consultant's main feature. Yet they are additionally a tiny company owner, and a portion of their time is committed to handling their branch workplace. As the leader of their technique, Edward Jones economic experts need the leadership skills to hire and manage staff, along with business acumen to create and perform an organization technique.

The Facts About Clark Wealth Partners Revealed

Proceeding education and learning is a required part of keeping a financial consultant permit - https://www.quora.com/profile/Blanca-Rush. Edward Jones financial experts are motivated to seek additional training to expand their expertise and abilities. Commitment to education safeguarded Edward Jones the No. 17 spot on the 2024 Educating pinnacle Awards checklist by Educating magazine. It's likewise an excellent idea for monetary advisors to participate in sector seminars.

Edward Jones monetary consultants appreciate the support and friendship of other monetary experts in their region. Our economic experts are motivated to use and get assistance from their peers.

Unknown Facts About Clark Wealth Partners

2024 Fortune 100 Best Firms to Job For, published April 2024, research by Great Places to Function, information as of August 2023. Settlement attended to utilizing, not getting, the score.

When you require assistance in your economic life, there are several experts you may look for assistance from. Fiduciaries and monetary advisors are two of them (civilian retirement planning). A fiduciary is an expert who handles cash or residential or commercial property for other parties and has a legal responsibility to act only in their customer's benefits

Financial advisors ought to arrange time each week to fulfill brand-new people and catch up with the individuals in their sphere. Edward Jones financial experts are fortunate the home workplace does the heavy training for them.

Little Known Facts About Clark Wealth Partners.

Proceeding education and learning is a required component of preserving an economic advisor license. Edward Jones financial advisors are encouraged to seek extra training to widen their knowledge and skills. Commitment to education and learning secured Edward Jones the No. 17 place on the 2024 Training peak Awards listing by Training publication. It's additionally a great concept for financial consultants to go to market conferences.

That implies every Edward Jones associate is cost-free to focus 100% on the customer's ideal passions. Our partnership structure is collective, not affordable. Edward Jones financial consultants appreciate the assistance and friendship of other monetary advisors in their region. Our monetary next advisors are motivated to supply and get assistance from their peers.

2024 Ton Of Money 100 Best Companies to Job For, published April 2024, study by Great Places to Function, data as of August 2023. Compensation gave for making use of, not getting, the rating.

Some Ideas on Clark Wealth Partners You Should Know

When you require help in your financial life, there are numerous professionals you may seek assistance from. Fiduciaries and monetary advisors are two of them. A fiduciary is a specialist that handles money or building for other events and has a lawful duty to act just in their customer's finest passions.